QR codes have revolutionized how we make payments and transactions, especially in China and India where they are popularly used. These codes contain vital information that can be instantly scanned using a smartphone camera, making it a hassle-free and efficient way of transferring funds. However, what makes QR codes even more impressive is that they offer numerous advantages compared to traditional point-of-sale systems. These advantages include:

Despite the growing popularity of QR codes-based payment systems, there are some concerns about security and reliability. Therefore, it is vital to stay vigilant and take necessary precautions to protect personal and financial information. Overall, QR codes offer a convenient, secure, and cost-effective solution for making payments and transactions. With their numerous advantages over traditional systems, QR codes will continue to grow in popularity in the coming years.

Introduction to QR Codes

QR codes, also known as Quick Response Codes, are two-dimensional barcodes that can store a large amount of data, including text, URLs, and other types of information. QR codes have been around since the mid-1990s, but their popularity has increased exponentially in recent years, thanks to the widespread adoption of mobile devices and digital payment technologies.

QR Codes in Transactions

QR codes are being used as a payment method, both online and offline, in various parts of the world, including China, India, and Japan. Merchants can display a QR code that represents the amount due for a purchase, and the customer uses their smartphone camera to scan the code and initiate the payment. This process is quick and easy, making it an attractive option for businesses and consumers alike.

Benefits of QR Codes in Payments

There are several benefits of using QR codes in payments and transactions:

Speed and Convenience: QR code payments are fast and convenient, as customers can complete their transactions with just a few taps on their mobile devices.

Low Cost: QR code payments are cost-effective for businesses, as there is no need for additional hardware such as card readers or cash registers to process payments.

Wider Reach: QR code payments can reach a wider audience, including people who do not have easy access to a bank account or credit cards.

Data Collection: QR code payments can help businesses collect valuable data on customer behaviour and preferences, which can be used to improve products and services.

QR Code Payment Process

The QR code payment process involves a few simple steps:

Step 1: The merchant generates a QR code that represents the amount due for a purchase.

Step 2: The customer scans the QR code using their mobile device’s camera.

Step 3: The customer confirms the payment and the funds are transferred to the merchant.

QR Code Payment Examples

QR code payments are already being used in various industries, including:

Retail: Large retailers such as Walmart and Target are using QR codes for in-store payments.

Ticketing: Transportation companies and event planners are using QR codes for ticketing and access control.

Utilities: Utility companies are using QR codes for bill payments and meter reading.

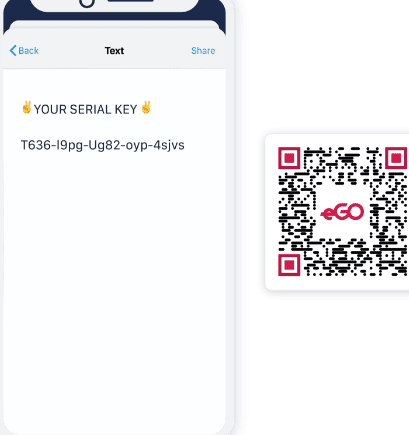

Security Concerns with QR Code Payments

While QR code payments offer many benefits, there are also some security concerns to consider:

Fraud: QR code payments can be vulnerable to fraud, as scammers can create fake QR codes and steal personal information.

Hacking: QR code payments can also be hacked if the customer’s device is infected with malware or if the QR code is intercepted by a hacker during the transaction.

User Error: Customers can also make errors when scanning QR codes, such as scanning the wrong code or entering the wrong amount.

QR Code Payment Adoption and Future

QR code payments are slowly gaining momentum worldwide, but their adoption rates vary in different regions. In China, QR code payments make up a significant proportion of all digital payments, while in the US, they are mainly used in a few select industries.

Looking ahead, QR code payments are expected to become more popular as more businesses adopt digital payment technologies and as consumers become more comfortable with using their mobile devices for payments. Time will tell if QR codes will eventually overtake traditional payment methods such as credit cards and cash, but for now, they offer an easy and cost-effective option for those looking to make quick and secure payments.