Looking for a fast, secure, and convenient way to make online payments? Look no further than QRPay! Wondering what QRPay actually is? It’s a mobile app developed by WSPay that uses QR codes to process digital payments. Here are a few key points to know about QRPay and the power of QR codes as a payment method:

Overall, QR codes and digital wallets like QRPay are taking the world of online payments by storm – and it’s easy to see why. Wherever you are and whatever you need to buy, QR codes and QRPay make it simple, fast, and secure.

Introducing QRPay – The Digital Wallet Payment Solution

QRPay is a revolutionary mobile application for online digital payments. With the aim of providing customers with the most secure payment method, QRPay was created by WSPay. This digital wallet offers a comprehensive range of digital payment options. One of the most unique features of QRPay is the use of QR codes as a method of payment. QR codes have been rapidly gaining popularity in the field of digital payments due to their convenience and security.

With QRPay, customers can easily pay for goods and services using their smartphones, without the need for traditional payment options like cash, credit or debit cards. QRPay’s state-of-the-art digital wallet is known for being one of the most secure payment methods currently available in the market.

Exploring the Relationship between QR Codes and Digital Wallets

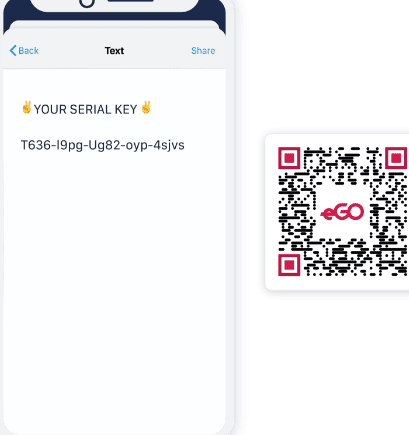

QR codes, also known as Quick Response codes, are two-dimensional barcodes that can be read by smartphones or specialized scanners. Each QR code contains a unique code that can be used to execute a specific task, such as making a payment or opening a webpage. QR codes have gained immense popularity as a preferred method of payment in digital wallets.

Digital wallets are mobile apps that store payment information, such as credit card details, and allow customers to easily make payments online, without the need for physical payment options. Digital wallets like QRPay use QR codes to authorize payment transactions. When a customer wants to make a payment, they only need to scan the QR code associated with the payment, and their payment information will be automatically processed by the digital wallet.

How QR Codes Provide Secure Digital Payments with QRPay

One of the most significant benefits of using QRPay for digital payments is the use of QR codes. As mentioned earlier, QR codes are unique two-dimensional barcodes that can be scanned using a mobile phone or scanner. Since each QR code serves a single purpose, such as a payment, the likelihood of fraudulent transactions is significantly reduced.

Additionally, QRPay’s state-of-the-art security measures mean that payment information is never stored on the user’s device, which means that even if the device is lost or stolen, the user’s payment information remains safe. Moreover, QRPay provides customers with a secure and easy-to-use mobile payment experience, thus eliminating the need to carry physical payment options.

Advantages of Using QRPay Mobile Application for Digital Payments

QRPay offers numerous advantages to customers who want to make digital payments. Here are some of the significant advantages of using QRPay:

- Easy to use and convenient. QRPay eliminates the need for physical payment options such as cash or cards, making payments easy and quick.

- Secure payment method. The use of QR codes and advanced security features ensures that customer data is protected.

- Widespread acceptance. With more than 20 million users worldwide, QRPay is widely accepted as a payment method in many countries.

- Integration with other payment methods. Customers can link their QRPay account with other payment options such as credit and debit cards.

- Low transaction fees. Customers can enjoy low transaction fees for using QRPay, making it a cost-effective option.

QRPay: The Payment Solution behind 20 Million Users Worldwide

QRPay has rapidly become a popular payment method worldwide, with more than 20 million users around the world. QRPay has achieved this level of popularity due to its simplicity and security. Additionally, QRPay’s widespread acceptance in many countries, such as China, Japan, and South Korea, has helped to increase its popularity.

QRPay’s success story is a testament to the growing trend of digital payments globally. As more people embrace digital payments, QRPay is fast becoming the preferred payment method for many.

How to Get Started with QRPay – A Step-by-Step Guide

Getting started with QRPay is easy. Here is a step-by-step guide to setting up your QRPay account:

- Download the QRPay app from the Google Play Store or Apple App Store.

- Register for a QRPay account by providing your name, phone number, email, and password.

- Verify your account by providing the necessary information.

- Link your QRPay account with your preferred payment options. You can link your account with credit and debit cards or bank accounts.

- Start making payments using QRPay. To make a payment, scan the QR code associated with the payment and confirm the payment details.

QRPay Vs. Other Digital Payment Alternatives – A Comparative Analysis

QRPay is one of the many digital payment options available today, and it is essential to understand how it compares to other alternatives. Here is a comparative analysis of QRPay vs. other digital payment options:

- Credit and debit cards: QRPay eliminates the need for physical credit or debit cards, thus providing users with greater convenience and security. Additionally, QRPay has lower transaction fees compared to cards.

- Mobile payment apps: QRPay is a mobile payment app and provides users with a secure payment method. Unlike other mobile payment apps, QRPay uses QR codes for payment authorization, thus reducing the likelihood of fraudulent transactions.

- Cryptocurrencies: While QRPay does not support cryptocurrencies, it provides customers with a secure and easy-to-use payment method for traditional currencies.

In conclusion, QRPay is a revolutionary mobile application for digital payments that uses QR codes as a payment method. QRPay is widely accepted worldwide and provides users with a secure and easy-to-use payment experience. With more than 20 million users worldwide, QRPay has become a popular payment solution, and its popularity is set to increase as more people embrace digital payments.