Ready to earn some cash back while you shop? Look no further than Venmo’s new QR code feature! Venmo users can now earn cash back while scanning participating merchant’s QR codes. Here’s what you need to know:

Don’t miss out on this easy way to save some cash! Keep an eye out for participating merchants and promotions in the Venmo app. Start scanning those QR codes today!

Understanding Venmo QR Codes

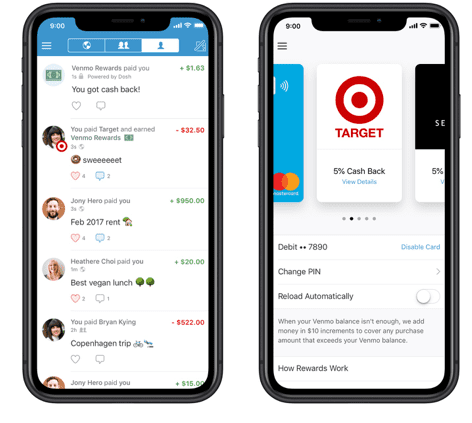

Venmo is a mobile payment service that allows users to easily send, receive, and transfer money from their mobile devices. Venmo QR codes are a recent addition to the popular app and represent a new way for users to make payments and receive cash back. In essence, Venmo QR codes are a type of barcode that can be scanned by other users to quickly send payments or initiate cash back transactions.

The primary advantage of Venmo QR codes is their convenience. With a simple scan of a code, users can easily make payments or claim cash back rewards. This streamlined process eliminates the need for manual input of payment information, which can be time-consuming and error-prone. Additionally, Venmo QR codes support contactless payments, which means users can make transactions without having to physically exchange cash or handle credit cards.

Basics of Cash Back with Venmo

In addition to making payments, Venmo also allows users to earn cash back rewards when they make eligible purchases with their linked Venmo debit card at participating merchants. The cash back rewards are automatically applied to the user’s Venmo account, and can be redeemed for cash or other rewards.

For qualifying purchases, Venmo cash back rewards typically range from 1-5% of the transaction total. The specific amount of cash back awarded depends on the merchant and the type of purchase. In many cases, Venmo also provides special offers and discounts to users who make purchases through the app, which can further increase the amount of cash back received.

How to Use Venmo QR Code for Cash Back

To use Venmo QR codes for cash back, users first need to ensure that their Venmo app is up to date and that their Venmo debit card is linked to their account. Once these requirements are met, users can follow these steps to earn cash back rewards:

- Open the Venmo app and navigate to the “Scan” tab at the bottom of the screen

- Scan the QR code displayed at the merchant’s point-of-sale terminal or in the merchant’s app

- Confirm the purchase amount and pay using the linked Venmo debit card

- The cash back reward will be automatically applied to the user’s Venmo account

It is important to note that not all merchants support Venmo QR code payments or cash back rewards. Users should check with the merchant before attempting to make a purchase using a Venmo QR code.

Venmo QR Code Cash Back Limitations

While Venmo QR codes offer a convenient way to earn cash back rewards, there are some limitations to be aware of. These include:

- Cash back rewards are only available for purchases made with a linked Venmo debit card

- Not all merchants support Venmo QR code payments or cash back rewards

- There is a limit of $500 in cash back rewards per calendar year

- Some purchases may be excluded from cash back rewards, such as gift card purchases or cash withdrawals

It is important for users to review the terms and conditions of the Venmo cash back rewards program to ensure that they understand the limitations and eligibility requirements.

Is Cash Back with Venmo QR Code Safe?

Venmo takes the security of its users’ financial information very seriously. All data transmitted during Venmo transactions, including those using QR codes, is encrypted to provide a high level of protection against unauthorized access or theft. Additionally, users are required to set up a PIN or use biometric authentication to access their Venmo accounts, which adds an additional layer of security.

However, users should still exercise caution when using Venmo QR codes or any other digital payment system. In particular, users should avoid sharing their Venmo login credentials with others or using Venmo to make purchases from merchants they do not trust. Venmo also recommends that users enable two-factor authentication for added security.

Alternatives to Venmo QR Code Cash Back

While Venmo QR codes offer a convenient way to earn cash back rewards, there are several alternatives available to users who are looking for additional flexibility or features. Some popular options include:

- Credit card rewards programs: Many credit cards offer rewards or cash back for purchases made using the card. Users who prefer to use credit cards for purchases may be able to earn more rewards by using a credit card with a good rewards program.

- Digital wallets: Other digital wallets, such as Apple Pay or Google Wallet, offer similar convenience and security features to Venmo. These wallets may also offer their own rewards programs or special promotions.

- Cash back apps: There are numerous apps available that allow users to earn cash back rewards for purchases made at participating retailers. These apps may offer higher cash back rates or additional features, such as couponing or price tracking.

In conclusion, Venmo QR codes offer a convenient way to earn cash back rewards for purchases made with a linked Venmo debit card. While there are some limitations and security concerns to be aware of, Venmo’s robust security features and user-friendly interface make it a popular choice for mobile payments and cash back rewards. For users who are looking for additional flexibility or features, alternative options such as credit card rewards programs or cash back apps may also be worth exploring.